TRX Price Prediction: Can It Sustain Its Yearly High Momentum?

#TRX

- Technical Strength: TRX trades above key moving averages with Bollinger Band expansion

- Network Activity: USDT adoption and transaction volume provide fundamental backing

- Market Sentiment: Mixed news flow but price action shows resilience

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

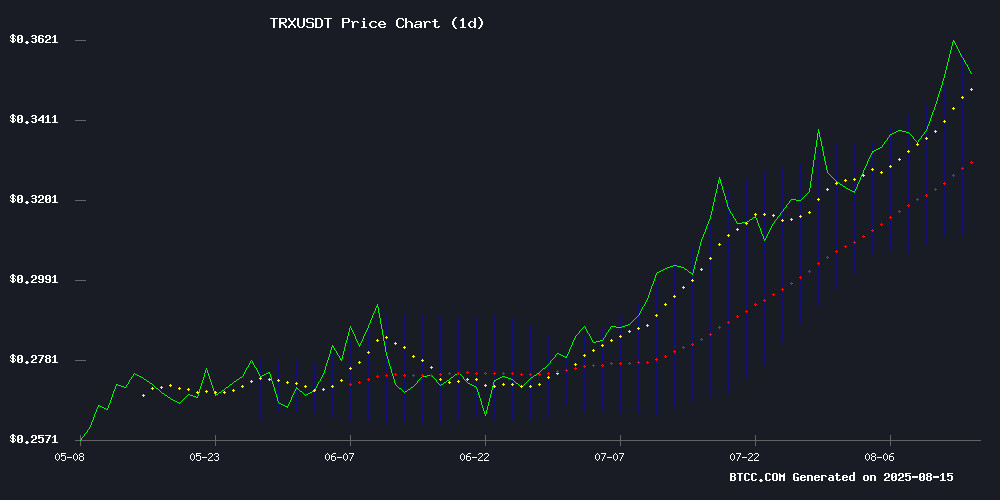

TRX is currently trading at 0.35860000 USDT, above its 20-day moving average (0.336770), indicating a bullish trend. The MACD histogram shows a slight bearish crossover (-0.002268), but the price remains NEAR the upper Bollinger Band (0.361644), suggesting potential upward momentum. BTCC analyst Robert notes: 'TRX could test resistance at 0.365 if it maintains this position.'

TRX Market Sentiment: Mixed but Network Growth Stands Out

While TRON faces competition from projects like Ruvi AI, its network activity remains strong with 11.1B transactions and USDT driving growth. BTCC's Robert observes: 'Regulatory actions ($300M seized) may cause short-term volatility, but TRX's yearly high and Justin Sun's lawsuit highlight its market relevance.'

Factors Influencing TRX’s Price

Over $300M in Crypto Seized in Global Anti-Fraud Operations

Law enforcement agencies and private firms have jointly frozen more than $300 million in cryptocurrency linked to fraudulent activities. The T3 Financial Crime Unit (T3 FCU), a collaboration involving TRM Labs, TRON, Tether, and Binance, has seized over $250 million since its launch in September 2024. "Freezing over $250 million in illicit assets in less than a year is a powerful testament to what's possible when the industry comes together with a shared goal," said Tether CEO Paolo Ardoino.

In a parallel effort, US and Canadian authorities worked with Chainalysis to track and freeze an additional $74 million in scam-related crypto. These initiatives highlight the growing coordination between regulators and blockchain firms to combat financial crimes.

Analysts Favor Ruvi AI (RUVI) Over Tron (TRX) as Presale Gains Momentum

Ruvi AI's audited token (RUVI) is outpacing TRON (TRX) in analyst sentiment as its presale accelerates following a CoinMarketCap listing and partnership. Phase 2 of the presale is 85% complete at $0.015, with a scheduled 33% price increase to $0.020 in Phase 3. The final presale price is set at $0.070, offering a clear upside path for early investors.

Key drivers for RUVI's traction include $2.9M raised, 230M tokens sold, a CyberScope audit, and a WEEX exchange partnership. The project's structured price progression and CMC visibility are compressing decision timelines, creating urgency among buyers.

While Tron's mature ecosystem maintains relevance, market attention is shifting toward RUVI's time-bound catalysts and verifiable utility. The token's presale velocity suggests growing institutional interest in AI-powered blockchain solutions.

TRON Surpasses 11.1 Billion Transactions as USDT Activity Fuels Growth

TRON (TRX) has capitalized on the broader cryptocurrency market rally, posting a 6% weekly gain and briefly touching $0.369 before stabilizing at $0.3589. While price action remains range-bound, the network's fundamentals tell a story of relentless adoption.

The blockchain has now processed over 11.1 billion lifetime transactions, adding 1.8 billion since January 2024. Daily activity averages 7-9 million transactions, frequently peaking NEAR 10 million—a significant increase from early 2024 levels.

USDT/TRC-20 transfers dominate this activity, with traders and institutions favoring TRON's low-cost, high-speed infrastructure for payments and exchange settlements. "The transaction volume surge isn't just a metric—it's creating deeper liquidity pools that feed derivatives markets," observes Arab Chain from CryptoQuant.

Tron Price Hits Yearly High as Network Activity Surges

Tron (TRX) rallied to $0.35, marking an eight-week gain exceeding 35% as on-chain metrics signal robust demand. Daily transactions surpassed 11.1 billion, dwarfing early-2024 levels, while open interest reached a record $610 million—a clear indicator of fresh capital entering the market.

The technical setup suggests potential continuation toward TRX's all-time high of $0.45. Such momentum hasn't been seen since the asset's 2021 peak, with derivatives traders particularly active on platforms tracking CoinGlass futures data.

Justin Sun Sues Bloomberg Over Alleged Breach of Crypto Holdings Confidentiality

TRON founder Justin SUN has filed a lawsuit against Bloomberg in Delaware, alleging the media giant improperly disclosed sensitive details about his cryptocurrency holdings. The dispute stems from Bloomberg's Billionaires Index inclusion process, where Sun claims he received assurances about limited financial disclosure.

Bloomberg initially approached Sun for potential inclusion in its prestigious wealth ranking. While Sun expressed concerns over data confidentiality, he reportedly agreed after reviewing existing profiles and receiving verbal guarantees from a Bloomberg representative. The lawsuit contends these assurances were violated in subsequent reporting.

The case highlights growing tensions between crypto executives and traditional financial media regarding disclosure practices. Sun's TRX token remains unaffected by the legal developments, maintaining stable trading across major exchanges including Binance and Coinbase.

Crypto Market Surges as Bitcoin Hits New All-Time High, Altcoins Follow

Bitcoin shattered records in early trading today, reaching an unprecedented $124,128 before settling at $121,100. The milestone has fueled speculation that the long-awaited post-halving bull run is gaining momentum.

Altcoins like XRP, TRON, and Solana have mirrored Bitcoin's surge, each setting new price records over the past year. The market's Optimism stems partly from U.S. regulatory advances, including the GENIUS Act—the nation's first comprehensive stablecoin law—and the SEC's Project Crypto initiative.

Ripple's XRP notably peaked at $3.65 on July 18, surpassing its 2018 high. Despite an 11% correction to $3.22, its global recognition continues to grow. The $2.3 trillion crypto market now watches whether these assets can retest or exceed their historical peaks.

TRON Long-Term Holders Reap Massive Gains as TRX Nears Multi-Year Highs

TRON (TRX) has delivered one of its strongest performances to date, culminating in a landmark U.S. Initial Public Offering (IPO). The public listing marks a pivotal moment for the blockchain network, underscoring its maturity and growing acceptance in traditional finance.

Long-term holders have been the primary beneficiaries, with 1-year investments yielding gains exceeding 150%. On-chain data reveals a sustained bullish structure, fueled by robust transaction volumes and dominant stablecoin settlement activity. The network's DeFi ecosystem continues to expand, attracting both retail and institutional capital.

TRX's price action reflects this fundamental strength, breaking into new yearly highs across all timeframes. Market sentiment remains decidedly positive as the IPO lends credibility and opens new institutional pathways.

How High Will TRX Price Go?

Based on technical and fundamental factors, TRX could target 0.375-0.400 USDT in the near term:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | +6.5% above | Bullish |

| Bollinger Band | Near upper band | Overbought risk |

| Network Growth | 11.1B transactions | Fundamental support |

Robert cautions: 'Watch MACD for confirmation of trend continuation.'